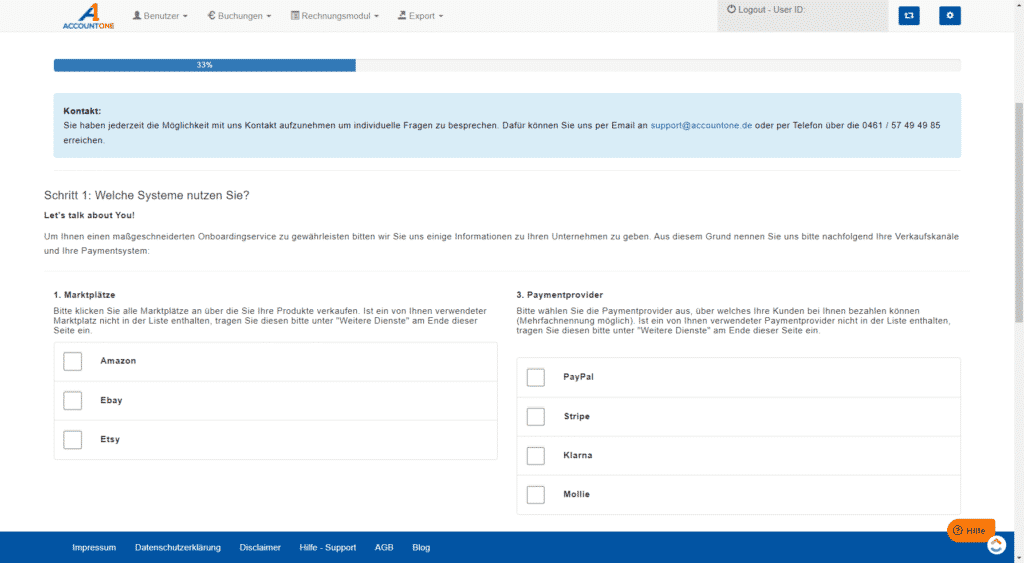

Registrieren Sie sich bei AccountOne

Die Registrierung ist schnell und einfach gemacht. Klicke dafür einfach auf den „Registrieren“-Button und melde dich bei uns an. Die Registrierung ist völlig kostenfrei und kann ohne Angabe von Zahlungsinformationen erfolgen. Anschließend stehen 14 Tage unverbindlicher Testzeitraum bereit.

0