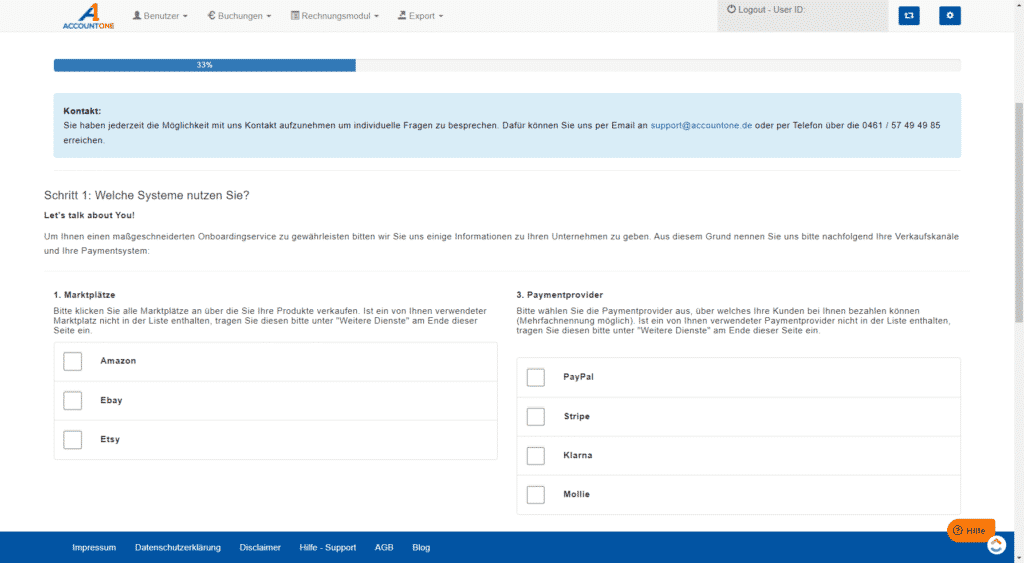

Register with AccountOne

Registration is quick and easy. Simply click on the "Register" button and log in with us. Registration is completely free of charge and can be done without providing payment information. You then have a 14-day non-binding trial period.

0