We are heading towards the end of this successful and exciting year. Many things have kept us busy this year. The closure of the marketplaces Allyouneed and Dawanda or missing payouts from Amazon. Also in the next year, many things will change again. In addition to the Annual Tax Act for VAT, this also includes the new delivery threshold in Switzerland.

Together with the Swiss tax consultant Gerrit Schröder from the GJS Consulting from Zurich, we have examined the topic for you.

As of 01.01.2019, the delivery threshold regulation will also apply in Switzerland - almost!

What the delivery threshold is has been explained in detail in so many blogs, articles and forums, so we will only briefly go into it.

The delivery threshold

Basically, according to the VAT law, a delivery that goes from one member state to another and is delivered to a private customer (B2C) is taxable where the delivery ends. In common parlance this is called "mail order regulation", the nerds among you can read about it in §3c paragraph 1 UStG: https://dejure.org/gesetze/UStG/3c.html . Prerequisite for this is that you arrange the delivery. Who has now clicked on the link and has read a little has perhaps already stumbled over the paragraph 3. Here we find a simplification rule for just such deliveries. As long as the total amount of the deliveries is below the delivery threshold, these deliveries are taxable where they begin. The amount of the delivery threshold is determined by each country itself (will probably change in 2021).

What does Switzerland have to do with the delivery threshold?

Good question! The delivery threshold is intended to guarantee that the countries in which the sales are generated also receive the sales tax. Now Switzerland is not in the EU and cannot participate in this regulation. However, since Switzerland is located in a similar language area as Germany, many Swiss buy from the mostly cheaper German online stores or marketplaces. By the way, there is no really comparable counterpart to Amazon in Switzerland, and according to the latest news, Amazon will not enter the Swiss market, at least not for the time being.

To get back to the topic, the Swiss feel disadvantaged by the prevailing regulations and certainly rightly so. On the one hand, purchases by Swiss in foreign stores reduce the purchasing power at home, and on the other hand, a lot of sales tax goes to other countries. The step to introduce a separate delivery threshold regulation is therefore understandable.

Old regulations on the delivery threshold in Switzerland until 31.12.2018

Until now there was no delivery threshold in Switzerland! But to understand how this delivery threshold works from 01.01.2019, we first look at how it works until 31.12.2018.

The regulation in Switzerland until 31.12.2018

Source: https://www.estv.admin.ch/estv/de/home/mehrwertsteuer/fachinformationen/regelung-fuer-den-versandhandel/

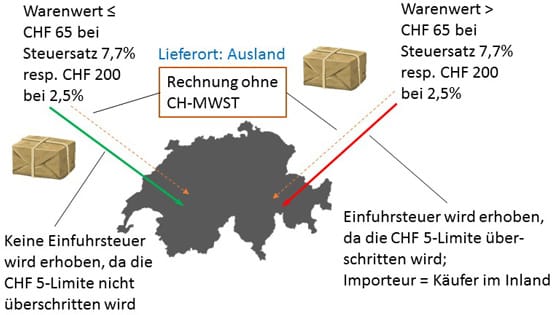

In the picture above you can see that Switzerland distinguishes two cases:

- Packages up to 65 CHF / 200 CHF

- Packages over 65 CHF / 200 CHF

This is related to the amount of sales tax. The regulation in Switzerland states that if the VAT on the import of the goods by the customer is lower than 5 CHF, it does not apply. This is the case if the order is less than 65 CHF at the tax rate of 7,7%, or less than 200 CHF at the reduced tax rate of 2,5%.

If the value of the order is above these values, sales tax is due. Now you surely ask yourself why you have never paid VAT in Switzerland... Switzerland is considered a "third country". If you currently deliver to Switzerland, this delivery is "non-taxable" from a German point of view and therefore no VAT is due in Germany. However, sales tax is incurred in Switzerland for the buyer. You can compare this with the German import sales tax. So far, the customer has paid the sales tax if the value of the orders was over 65 or 200 CHF.

Delivery threshold Switzerland from 2019

Supply threshold regulation from 2019 in Switzerland

Source: https://www.estv.admin.ch/estv/de/home/mehrwertsteuer/fachinformationen/regelung-fuer-den-versandhandel/

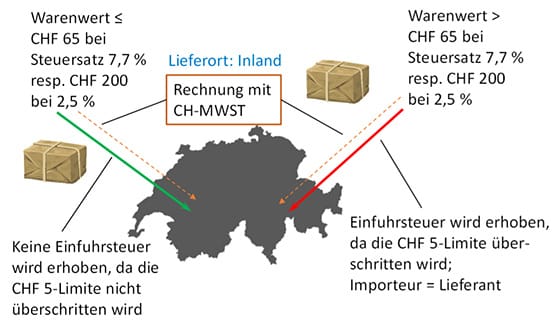

So from 01.01.2019 there is something similar to the delivery threshold in Switzerland. This differs from the EU delivery threshold in one particular point. Since up to now all deliveries over CHF 65 or 200 were taxed by the buyer in Switzerland anyway, they are not included in the tax base. In order to determine whether the delivery threshold to Switzerland has been exceeded, we therefore only look at the small consignments up to 65 or 200 CHF.

If we reach an amount of 100,000 CHF within one year with the small consignments, we become liable to pay tax in Switzerland. From then on, by the way, deliveries over 65 or 200 CHF are also taxable in Switzerland by the trader.

What happens if I exceed the delivery threshold to Switzerland?

If we now exceed the delivery threshold of CHF 100,000 with our small deliveries (up to CHF 65 / 200), we must register for tax in Switzerland. By the way, this also applies if you have already exceeded the delivery threshold in 2018, then registration will be mandatory as of 01.01.2019.

The registration is done by a tax representative based in Switzerland. For this you are welcome to contact Gerrit Schröder from the GJS Consulting from Zurich.

Alternatively, you can of course register for tax before you reach the delivery threshold. For example, if you are already close to exceeding the threshold and want a clean transition.

List of registered dealers in Switzerland

Once you are registered for tax purposes in Switzerland, you will be entered in a list at the Swiss Federal Tax Administration. So everyone can see that you pay your taxes properly in Switzerland and deliveries from you do not lead to import VAT for the customer.

Pack the package correctly

Since it is not easily recognizable from the outside that you are registered for tax in Switzerland, some adjustments to your packaging style are required. On the address label you must print your name or the name of your company and the VAT number from Switzerland. In addition, an invoice with Swiss VAT must be attached to the package.

Customs clearance in Switzerland

To make your life as easy as possible. Set Gerrit Schröder a nearly automated customs system at your disposal. This allows you the lean and digital processing of customs formalities.

The German Accounting

AccountOne monitors the delivery threshold to Switzerland for you and differentiates between small and large deliveries. If an overrun is imminent, we will inform you in time and pass on the data to the accounting department or your tax advisor after the overrun. You can concentrate on the sale as usual.